List of vehicles machinery equipment to be purchased. Hire purchase loan is only one of the many loans we can offer.

Loan Interest Rates Flat Rates Vs Fixed Rates Vs Variable Rates Loan Interest Rates Personal Loans Bugeting

Shopping for a car loan for your new or used car.

. In Malaysia when you take out a loan from the bank to purchase a new car youre essentially entering. Most car loans in Malaysia have a maximum margin of financing of 90 so you should always expect to pay at least 10 upfront to the car dealer. Banks usually offer a maximum term of 9 years on the loan.

In a hire purchase loan you are the vehicles tenant and the credit provider is the owner of the vehicle. Car loans commonly offer a maximum margin of financing of 90 hence you are expected to pay 10 of the car value to the dealership. Calculated Interest Charges RM.

The term hire purchase is often also referred to as car loans. Call 6019-999 4012 for Free Consultation. Compare Personal Loan Lenders.

The Hire Purchase Interest Rates are currently being updated. 35 x RM 70000 x 5 RM 12250. Choose a hire purchase loan which is suitable to your needs.

Get estimate from our hire purchase calculator to help you to calculate possible monthly repayments. For a majority of car buyers a hire purchase. The interest rate is priced at 340 annually and you can extend the repayment period for as long as 9 years.

If you plan on getting a fixed rate hire purchase loan a 7-year repayment plan will generally have a 320 interest rate and an RM525 monthly rate. Fast decision upon submission. Bank Negara Malaysia wishes to announce that beginning 13 July 2000 finance companies are allowed to pay a handling fee of up to but not exceeding RM600 to car dealers for each hire purchase financing case forwarded by the car dealer to the finance company as payment for certain services provided by the car dealer as follows.

318 pa Updated May 2017. Monthly Interest RM 12250 5. 4WD MPV SUV Sedan and Motorcycle.

Compare Car Loans in Malaysia 2022. This should be one of the. A Shariah-compliant plan for new and existing Maybank Islamic car financing customers.

We offer to hire purchase loan for you to buy your dream car with low-interest rate and flexible repayment scheme. Generate car loan estimates tables and charts and save as PDF file. Key in Car price Downpayment Loan No.

Malaysia car loan calculator to calculate monthly loan repayments. Here is how your total interest monthly interest and monthly installment will be calculated based on the formula above. What Is Hire Purchase.

Takaful Auto Credit Plan. Form A Form B and or Form 8 Form 9 whichever is applicable 3. Typically they buy a vehicle with a hire purchase loan.

To illustrate further see the car loan. Unless you are familiar and up-to-date with the credit guidelines of each bank in Malaysia it can be very difficult. Own your dream car today.

Compare and calculate your monthly repayments on Loanstreets car loan calculator and save more than RM100 every month. Upon submission of complete documents with stable internet connection. We will invest our time to understand your financial needs and provide you with tailor-made creative and.

Things you should know about hire purchase loans in Malaysia. 000 Total Payment RM. Find a competitive interest rate for your hire-purchase from 18 banks in Malaysia.

Perfect financing plan for all types of vehicles. Zoom plus normal zoom minus. Lets circle back to the same example where your car loan is at RM70000 with an interest rate of 35 percent and a five-year loan period.

Set Recurring select Effective Start End Dates if you want your payment to be automatically deducted on a monthly basis for subsequent months. In exchange the borrower is indebted to pay back the loan amount plus interest because the lender needs to earn a profit from providing the loan. Public Bank Aitab Hire Purchase-i.

90 of Net Income 10 if professional Knowing Your Maximum Borrowing Eligibility. Fast Easy Approval. Select Pay Transfer.

Though paying in cash is the best way to avoid interest rates from borrowing we dont always have enough money on hand to buy a car. Written by iMoney Editorial. 80 of Net Income 10 if professional RM10000.

80 of Net Income. Some examples would be. Form applicants may refer to the Treasury Circular at thePortal Pekeliling Perbendaharaan Kementerian Kewangan Malaysiaunder the heading Pengurusan Wang Awam WP.

Learn More 3 types of Car Insurance in Malaysia find out How Much You Can Loan From Bank. Low Fixed APR from 399. Hire purchase is one of the most commonly used methods to buy cars in Malaysia.

Home Personal Banking Banking Loan AKPK Financial Management and Resilience Programme URUS Hire Purchase Vehicle Financing. Of Years and Car Loan Interest Rate The calculator will automatically calculates the Loan Amount Total interest charges and Monthly payment for you. Please confirm the rates or charges with the respective banking institution.

Form 24 and or Form for Section 78 where applicable 4. Interest Rate pa. Key in Amount and Effective Payment Date.

Ad Get Up to 100000 from 349 APR. The Best Car Loans in Malaysia. Select Maybank Hire Purchase.

All outstanding financing amount for your car will be paid in the event of Death or Total and Permanent Disability during financing tenure. How to use Hire Purchase Car Loan Calculator Malaysia. In this example you select Maybank Hire Purchase to finance your car purchase.

Hire Purchase Loan KL Selangor Malaysia. A car loan is also known as a hire purchase loan. Form 49 and or Form for Section 58 where applicable 5.

Hong Leong Auto Loan. The term hire purchase is derived from the fact that when you take up a car loan the car technically belongs to the lender ie. We also have Housing Loan Personal Loan Business Loan and many more.

Financing plan for New Used and Unregistered Reconditioned Vehicles For examples. You may be those individuals who would like to buy high costing equipment for your business. For the purchase of a new car Maybank is offering up to 90 margin of finance with you covering the remaining 10.

Hiring Period in Years Calculate. 70 of Net Income 10 if professional RM10000. APR or the annual percentage rate.

75 of Net Income. Cash Money is a privately held company and a team of private money lenders dedicated to the financing and leasing of hire purchase commercial equipment and factoring of commercial accounts receivable in Malaysia. To lessen the amount of interest it is advised to pay a higher percentage upfront.

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan Public Sector Home Financing Information

Hire Purchase Car What Is It Advantages Of A Lease Purchase Agreement Cars For Sale Hybrid Car Used Cars

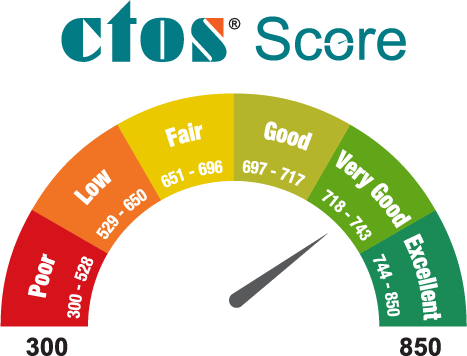

Car Loan Eligibility Calculator Ctos Malaysia S Leading Credit Reporting Agency

The Malaysia Type Of Car Loan Proton June 2022 Tax Holiday Rebate Rm7000 Interest Rate As Low As 2 8

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan Public Sector Home Financing Information

Public Bank Covid 19 Assistance For Affected Customers Malaysia Central Id

The Pros And Cons Of Freehold And Leasehold Property Freehold Investment Property Things To Come

Personal Loan Contract Template Elegant Sample Personal Loan Agreement Letter Between Friends Contract Template Good Essay Resume Template Free

What You Should Know About Hire Purchase Loans In Malaysia Ezauto My

Pdf The Concept Of Future Islamic Automobile Financing Based On Maqasid Shariah

A Guide To Car Loans Interest Rates In Malaysia

Best Car Loans In Malaysia 2022 Compare And Apply Online

How Much Can You Borrow Based On Your Dsr

Covid 19 Moratorium Guide To Financial Relief Measures In Malaysia

2021 Hire Purchase Moratorium Explained In Detail